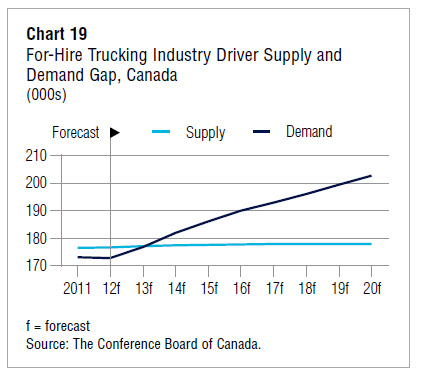

Supply-Demand Gap 2011-2020

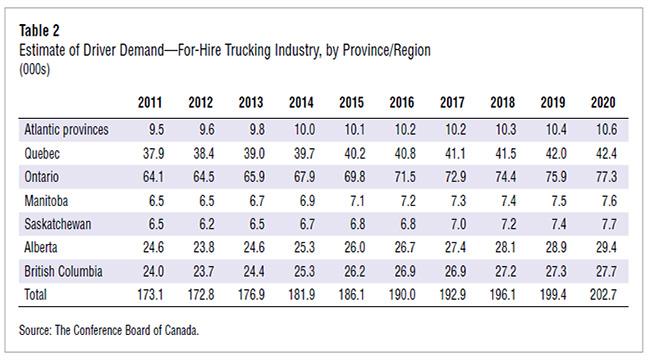

The gap at the national level is about 25,000 (24,700) drivers by 2020—or about 14 per cent of the anticipated driver population—assuming year-over-year productivity increases of two-thirds of 1 per cent. A lower productivity performance, which is possible, would push the gap to over 33,000 drivers. As can be seen in the regional data, there […]

Click Here...